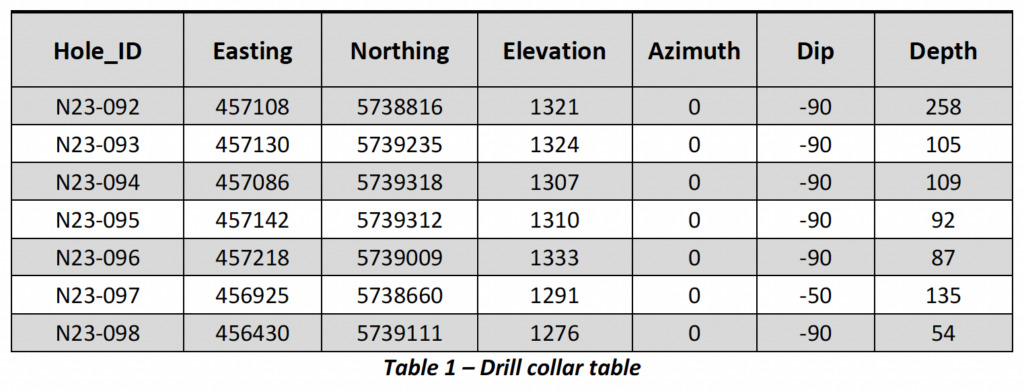

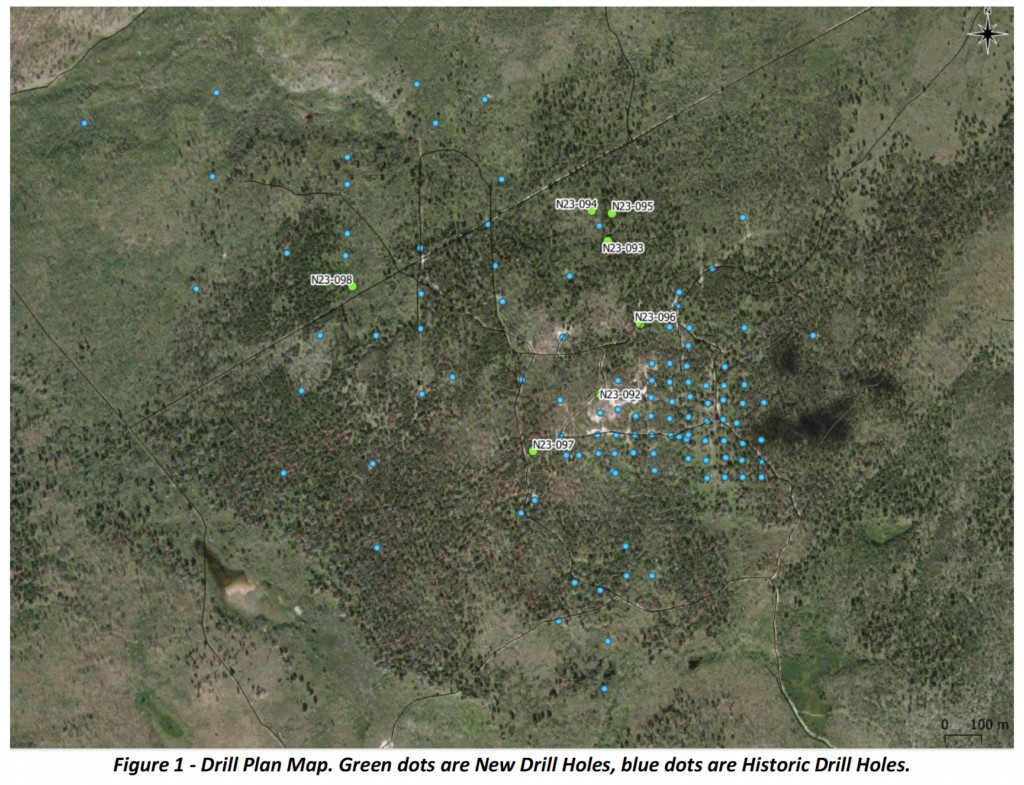

CARLYLE COMMODITIES CORP. (CSE:CCC, FSE:BJ4, OTC:CCCFF) (“Carlyle” or the “Company”)is pleased to announce the completion of a new diamond drill program at the Newton Project. The drill program completed 840.3 metres of drilling across 7 (seven) drill holes, and successfully tested multiple high priority targets with aims of increasing both tonnage and ounces of gold and silver in the Company’s current National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Newton Project Resource Calculation.All seven holes have been sampled and sent to Bureau Veritas, an ISO 9001 certified independent lab for analysis. The Company expects to receive initial results in the coming weeks.

Drill Program Overview

The targets of this 7-hole drill program included surface geochemical gold anomalies, open mineralization, and mineralized volcanic and intrusive rocks from historic distal drilling, with the intention of increasing the NI 43-101 inferred mineral resource, expanding potential higher-grade areas near surface, and exploring potential new zones of mineralization on the property. At the Newton Project, gold is hosted in felsic volcanic, mafic volcanic, and quartz porphyry intrusive rocks. This drill program intersected all of these lithologies in varying degrees of alteration and associated sulphide deposition, and all holes successfully intersected their primary targets.

Drill Program in Detail

Hole N23-092

Hole N23-092 was drilled 50 metres north of hole 10016 where the inferred mineral resource remains open to the northwest along a broad corridor. The hole was drilled to a depth of 258 m and intersected strongly altered quartz feldspar porphyries intruding altered felsic volcanic rocks with disseminated and fracture-controlled pyrite.

Holes N23-093, N23-094, and N23-095

Holes N23-093, 94, and 95 were drilled approximately 350 – 450m north of the NI 43-101 inferred mineral resource boundary, around historical hole 10030. Hole 10030 intersected 24 metres of 0.83 g/t Au from 18.0 – 42.0 metres in propylitic altered mafic volcanics associated with an IP chargeability anomaly. As such, this area represents a potential higher grade near surface area of significant interest.

The Company drilled three holes around hole 10030, triangulating 50m step outs to the northeast, southwest, and northwest of this hole to investigate possible continuation of this mineralization. These holes were also plotted based on gold-in-soil geochemical anomalies and elevated IP chargeability anomalies proximal to hole 10030. All three holes intersected propylitic altered mafic volcanics with disseminated and fracture-controlled sulphides from surface to the approximate total depth of 100m in each hole.

Hole N23-096

Hole N23-096 was drilled more than 100 meters north of the inferred mineral resource where historic trenching, rock and soil sampling all returned significant gold values at surface. The hole was drilled to 87 metres and intersected very strongly altered felsic volcanics with disseminated and fracture-controlled sulphides to a depth of 24 metres. The hole cut altered mafic volcanics from 24 to the total length of 87 metres, including small metre scale felsic intrusive.

Hole N23-097

Hole N23-097 was drilled immediately west of the inferred mineral resource where mineralization is open and begins at surface, demonstrated in historic trenching and drilling. The hole was drilled to a depth of 135 metres and intersected strongly altered quartz feldspar porphyry with disseminated and fracture-controlled sulphides as pyrite – chalcopyrite ± sphalerite veinlets.

Hole N23-098

Hole N23-098 was drilled 750 meters northwest of the inferred mineral resource targeting a gold-in-soil geochemical anomaly proximal to historic drill holes that intersected felsic volcanics and quartz feldspar porphyry. This hole was drilled to 54.0 metres and intersected altered quartz feldspar porphyry with disseminate and vein hosted pyrite.

Management Comments

Mr. Morgan Good, President and Chief Executive Officer, commented: “We are very pleased with this efficient 7-hole drill program and the professional work of our team. All holes successfully intersected our primary targets. We look forward to our results and continuing to advance the Newton project in 2024.”

Mr. Jeremy Hanson, VP of Exploration, stated: “We are excited about the holes we completed, there was a lot of productive activity completed in a short time frame. The drill team tested a variety of high potential targets where much of the core contained strongly altered rocks, disseminated and veined sulphides. We are certainly looking forward to our results and getting back on the ground.”

Newton Gold Project Summary

The Newton Gold Project contains a current NI 43-101 resource calculation effective June 13, 2022 (the “Updated Newton Resource Calculation”), which utilizes optimized pit shell constraints to fulfil the requirement for “reasonable prospects for eventual economic extraction”. The inferred mineral resource contains 861,400 oz of Au, and 4,678,000 oz of Ag with an average grade of 0.63 g/t Au, a cut off of 0.25 g/t Au throughout 42,396,600 tonnes.

The Newton Gold Project deposit remains open in multiple directions with potential for increased size, grade, and additional mineralized areas. The current inferred mineral resources occupy only approximately 7% of the area of an underlying broad induced polarization (“IP”) anomaly. Immediate areas for follow up include south and southwest of the current inferred mineral resource, where historic drilling has intercepted mineralized volcanics, which are not part of the Updated Newton Resource Calculation, as well as down dip to the southwest, where the mineralization remains open. Much of the large Newton Gold Project sulphide-bearing alteration zone, as defined by Amarc Resources Ltd.’s (“Amarc”) 2010 IP survey, has not been thoroughly explored. The Newton Gold Project gold deposit lies within a northwest trending total field magnetic low that extends approximately 500 m to the northwest beyond the deposit as defined by the densest drilling, to an area where the few exploration holes returned geologically important intersections of greater than 100 ppb (0.1 g/t) Au, such as hole 92-03 that returned 54 m grading 0.50 g/t Au including 30 m grading 0.70 g/t Au, and hole 10023 that returned 39 m at 1.21 Au, indicating potential to host additional resources. In addition, to the north, mineralization in hole 12076 has not been fully explored and in the south, the mineralized intervals in hole 12086 are indicative of resource potential in this vicinity.

Project Highlights

- The Newton Gold Project is a large, bulk tonnage, low – to intermediate-sulphidation, epithermal gold deposit with nearly 35,000 m of drilling exploring and developing the historical resource, primarily between 2009-2012.

- Updated pit-constrained inferred mineral resource contains 861,400 oz of Au, and 4,678,000 oz of Ag with an average grade of 0.63 g/t Au, a cut off of 0.25 g/t Au throughout 42,396,600 tonnes.

- The Newton Gold Project encompasses more than 24,000 ha.

- The Updated Newton Resource Calculation occurs within an 800 x 400 m area defined by drilling to depths of approximately 500 m with majority of the holes not exceeding 300 m depth.

- Underlying the deposit, a large IP anomaly measures 4 km x 2 km and covers an area greater than 7 km2 – yet the existing inferred mineral resource occupies slightly over 0.5 km2 or just 7% of the anomaly.

- Gold and associated base metal mineralization precipitated in extensive zones of strong quartz-sericite alteration as well as in mafic volcanic and clastic sedimentary rocks and along fault and fracture zones.

- The alteration assemblages and metal associations at the Newton Gold Project are similar to the Blackwater gold project deposit of Artemis Gold Inc. (“Artemis”). The Blackwater gold project, which is in construction phase, is located approximately 185 km northeast of Newton, where it is one of Canada’s largest open-pitable gold deposits and one of the world’s largest environmental assessment approved gold development projects. Blackwater has a measured + indicated resource estimated at 11.7 million ounces Au and 122 million ounces of Ag (see Artemis’ “Blackwater Gold Project British Columbia NI 43-101 Technical Report on Updated Pre-Feasibility Study”, authored by Robin Kalanchey, et al., September 10, 2021; www.artemisgoldinc.com).

A copy of Carlyle’s NI 43-101 compliant “Technical Report on the Updated Mineral Resources Estimate for the Newton Project, Central British Columbia, Canada” dated June 13, 2022 authored by Michael F. O’Brien, P.Geo., and Douglas Turnbull, P.Geo., which contains the Updated Newton Resource Calculation, is available under Carlyle’s profile on SEDAR+.

Quality Assurance/Quality Control

Carlyle Commodities has applied a rigorous quality assurance/quality control program at the Newton Project using best industry practice. All core was logged by a geoscientist. The Newton Project drill core was drilled at NQ diameter. The drill core was split in half using a core saw and each sample half was placed in a marked sample bag with corresponding sample tag then sealed. The remaining half core is retained in core boxes that are stored in a secure facility. The chain of custody of samples was recorded and maintained for all samples from the drill to the laboratory. All samples were shipped to an ISO 9001 certified independent laboratory. A minimum of 5% of certified reference samples and duplicates were inserted into the sample sequence.

Qualified Person

Jeremy Hanson, P.Geo. a Qualified Person, as such term is defined by NI 43-101, has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Historical information contained in this news release cannot be relied upon. Mr. Hanson has not prepared nor verified the historical information.

About Carlyle

Carlyle is a mineral exploration company focused on the exploration and development of its 100% owned Newton Gold Project, located in the Clinton Mining Division of B.C. The Company is listed on the CSE under the symbol “CCC”.

ON BEHALF OF THE BOARD OF DIRECTORS OF

CARLYLE COMMODITIES CORP.

“Morgan Good”

Morgan Good

President and Chief Executive Officer

For more information regarding this news release, please contact:

Morgan Good, CEO and Director

T: 604-715-4751

E: morgan@carlylecommodities.com

W: www.carlylecommodities.com

Cautionary Note Regarding Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance, including without limitation, statements regarding the impact of the drilling program on the current inferred mineral resource for the Newton Gold Project, the Company’s expected timeline for receipt of the initial results of the lab analysis of the drill program and the Company’s plans to continue to advance the Newton project in 2024 are forward-looking statements and contain forward-looking information. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should” or “would” or occur.

Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this press release, including, without limitation, that the phase 2 drill program will impact the inferred mineral resource calculation for the Newton Gold Project as anticipated, that there will be no adverse changes in legislation, policies, or rules that impact the Company’s ability to continue to pursue its business objectives as expected, that the Company will not come across any land access, environmental or social issues that impact its business plans, that the Company will have access to the resources required to continue to advance the Newton project in 2024 and to complete the lab analysis for the drill program and that the Company will receive the initial results of the lab analysis in the expected timeframe.

These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance, or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important factors that may cause actual results to vary, include, without limitation: that the drill program will not impact the Company’s current inferred mineral resource estimate as anticipated or at all; that managements hypotheses for mineralization on the Newton Gold Project is incorrect; general business, economic and social uncertainties; the Company’s failure to secure the resources required to continue to advance the Newton Project as currently planned or to complete the lab analysis of the drill program as anticipated, or at all; unanticipated delays in the completion of the lab analysis of the drill program; the loss of key personnel; unanticipated costs; adverse litigation, legislative, environmental, and other judicial, regulatory, political, and competitive developments; and other risks outside of the Company’s control. Further, labour shortages, high energy costs, inflationary pressures, rising interest rates, the global financial climate and the conflict in Ukraine, Israel and Palestine and surrounding regions are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the Company’s operating performance, business plans, financial position, and future prospects. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. These forward-looking statements are made as of the date of this news release and, unless required by applicable law, the Company assumes no obligation to update these forward-looking statements.

Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.