NEWTON GOLD PROJECT

Newton Sale to Axcap were as follows:

- $500,000 in cash payments;

- 500,000 common share purchase warrants of Axcap (the “Payment Warrants”), exercisable at $0.20 per share until June 3, 2028;

- 3,750,000 common shares of Axcap (the “Initial Payment Shares”); and

- Common shares of Axcap valued at $1,250,000 (the “Secondary Payment Shares”) to be issued 12 months following closing of the Transaction (June 6, 2026) at a 20-day VWAP leading up to the anniversary of the Transaction, subject to Canadian Securities Exchange minimum pricing requirements.

If the Newton Property can reach the feasibility study phase Carlyle will further receive considerable equity of Axcap, not forgetting the 500,000 warrants as well as the $1,250,000 worth of equity incoming on June 6, 2026, in addition to the cash already received.

Additionally, upon completion of certain milestones, as set forth below, Axcap will pay Carlyle the following consideration:

| Milestone |

Share Payment |

Cash Payment |

|---|---|---|

| 2,000,000 oz Au (Measured or Indicated Resource) |

2,500,000 shares |

$250,000 |

| 3,000,000 oz Au (Measured or Indicated Resource) |

5,000,000 shares |

$250,000 |

| Completion of NI 43-101 Pre-Feasibility Study |

5,000,000 shares |

$500,000 |

| Completion of Bankable Feasibility Study |

10,000,000 shares |

$1,000,000 |

| 2,000,000 oz Au (Measured or Indicated Resource) |

2,500,000 shares |

$250,000 |

Our Focus

Advancing BC assets and boosting capital and valuation through potential AXCP market success from Carlyle’s equity stake.

NEWTON GOLD SILVER PROJECT - BC

- June 2022 NI 43-101 Inferred Resource of 861,400 ounces of gold at 0.63 g/t average deposit grade & 4,678,000 ounces of silver at 3.43 g/t

- 0.63 g/t average deposit grade in line with Artemis Gold’s Blackwater Project

- The geological terrain, geology, and deposit mineralization are extremely similar between Newton and Blackwater

BLACKWATER GOLD PROJECT - BC

- In Production

- ~11.9M ounces of Au M+I

- ~$8B market cap

Our Focus

Advancing BC assets and boosting capital and valuation through potential AXCP market success from Carlyle’s equity stake.

NEWTON GOLD SILVER PROJECT - BC

- June 2022 NI 43-101 Inferred Resource of 861,400 ounces of gold at 0.63 g/t average deposit grade & 4,678,000 ounces of silver at 3.43 g/t

- 0.63 g/t average deposit grade in line with Artemis Gold’s Blackwater Project

- The geological terrain, geology, and deposit mineralization are extremely similar between Newton and Blackwater

BLACKWATER GOLD PROJECT - BC

- In Production

- ~$8B market

- ~11.9M ounces of Au M+I

- ~$8B market cap

PROJECT OVERVIEW

UNRIVALLED PRECIOUS METALS PROJECT UPSIDE

34,000+ m & 128 total drill holes

24,000+ Ha

Resource occupies 0.5 sq/km (7%)

| Resource in Optimized Pit (inferred) | Grade | Metal Content | ||||

|---|---|---|---|---|---|---|

| Cut Off Au |

Mass t |

Au (g/t) |

Ag (g/t) |

AuEQ³ (g/t) |

Au (t.oz) |

Ag (t.oz) |

| 0.25 | 42,396,600 | 0.63 | 3.43 | 0.68 | 861,400 | 4,678,000 |

Notes

1. CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014) and CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (November 2019) were used for mineral resource estimation.

2. Recovery factors used are 92% for Au and 45% for Ag.

3. metal prices used are US$1900/oz for Gold and US$25/oz for Silver

4. O’Brien, M.F., (2022) Technical Report on the Updated Mineral Resource Estimate for the Newton Project, central British Columbia

Alteration Types

Epithermal Gold

Gold Mineralization

Strong quartz-sericite

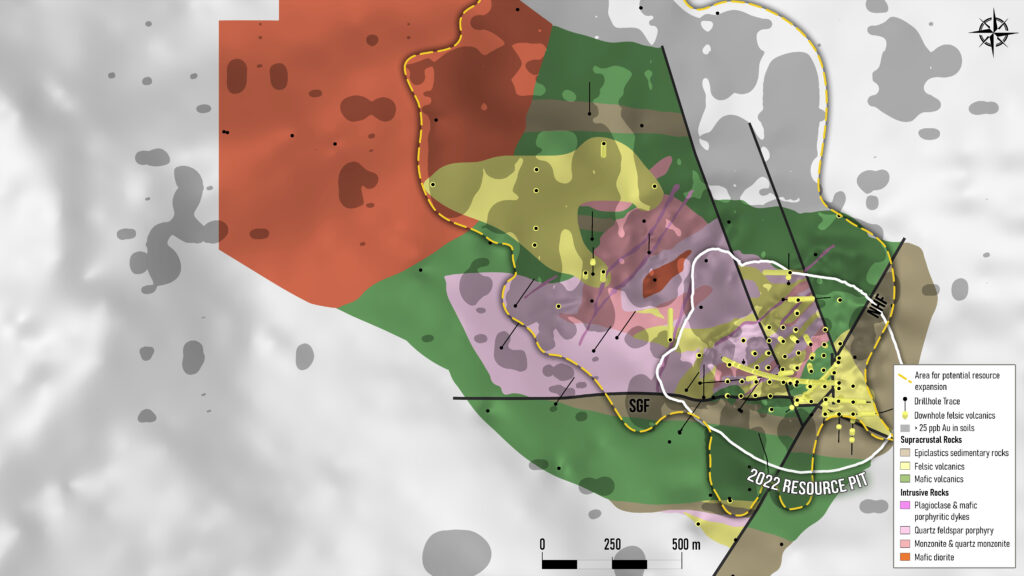

RESOURCE UPSIDE OF EXISTING DEPOSIT

AU SOIL ANOMALY

RESOURCE UPSIDE OF EXISTING DEPOSIT

AU SOIL ANOMALY

| Drill Hole ID | From (m) | To (m) | Int. (m) | Au (g/t) | Ag (g/t) |

|---|---|---|---|---|---|

| 9001 | 228.0 | 297.0 | 69.0 | 1.41 | 10.9 |

| 9003 | 3.0 | 224.5 | 221.5 | 0.60 | 5.6 |

| 9004 | 6.0 | 195.0 | 189.0 | 1.56 | 7.9 |

| 9014 | 72.0 | 210.0 | 138.0 | 0.74 | 4.2 |

| 11040 | 15.4 | 171.0 | 155.6 | 0.58 | 2.9 |

| 11045 | 79.0 | 157.0 | 78.0 | 1.71 | 5.1 |

| 11049 | 23.5 | 144.0 | 120.5 | 0.86 | 2.2 |

| 11052 | 48.0 | 456.0 | 408.0 | 0.60 | 2.6 |

| 11054 | 43.0 | 442.0 | 399.0 | 0.50 | 2.4 |

| 12060 | 11.6 | 333.0 | 321.3 | 0.55 | 3.0 |

Select Drill Intercepts

FOOTBALL FIELDS OF CONTIGUOUS PRECIOUS METALS ZONES

Main Zone – Vein Stockworks

- Typically, around 2 gpt Au

- Up to 8 gpt Au

- Ag can reach up to 200 gpt

- Pb, Zn, Mo are present as well

- The IP anomaly measures 4 km x 2 km and covers an area greater than 7 sq/km

- Yet, the current resource occupies slightly over 0.5 sq/km or just 7% of the anomaly

IP ANOMALY

Coincident IP and gold-in-soil anomalies, along with near-surface high-grade intercepts, define strong exploration potential beyond the known resource. Limited drilling has so far tested only 7% of the IP anomaly, leaving significant room for expansion within surrounding and overlooked geological domains.

Main Zone – Vein Stockworks

- Typically, around 2 gpt Au

- Up to 8 gpt Au

- Ag can reach up to 200 gpt

- Pb, Zn, Mo are present as well

- The IP anomaly measures 4 km x 2 km and covers an area greater than 7 sq/km

- Yet, the current resource occupies slightly over 0.5 sq/km or just 7% of the anomaly

IP ANOMALY

Coincident IP and gold-in-soil anomalies, along with near-surface high-grade intercepts, define strong exploration potential beyond the known resource. Limited drilling has so far tested only 7% of the IP anomaly, leaving significant room for expansion within surrounding and overlooked geological domains.

NEWTON PROJECT HISTORY

1916 - PRESENT

1916

1972-1997

2004 -2006

2009 -2012

2020

Exploration & Drilling Highlights

Expansive Mineralized System

Strong Geological Indicators

Subheading 3: Notable Drill Results & New Zones

Continuous felsic domains exceeding 1,000m confirmed.

Consistent Au-Ag mineralization from surface to >600m depth, open at depth.

High-grade intercepts include:

25.5m @ 1.52 g/t Au & 6.01 g/t Ag (N23-089)

18m @ 1.65 g/t Au & 1.83 g/t Ag (N23-091)

30m @ 1.24 g/t Au & 1.6 g/t Ag from 413m

Drilling also confirmed a new near-surface high-grade zone — the “Halo Area” — returning 39m @ 0.75 g/t Au from 14.9m (N23-093).

Mineralization remains open in multiple directions, with additional gold and silver zones discovered farther northwest in the newly identified

“Sunrise Area.”

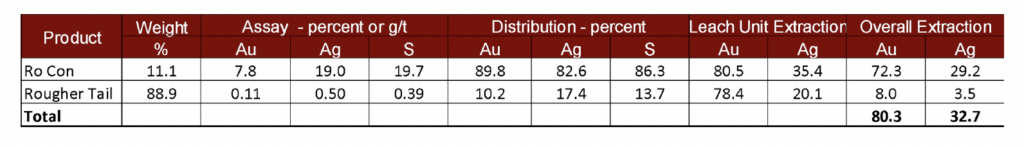

80% GOLD RECOVERY

2024 PRELIMINARY METALLURGICAL RESULTS